Quarterly EntryPoints: Q4 2023

Hopefully you have enjoyed a great start to 2024 and are progressing on your journey to pursue your life goals and build wealth. Many of the themes we saw at the end of 2023 have continued into the new year. We plan to pay close attention to geopolitical concerns, The federal government’s actions and economic data to continue to potential portfolios effectively.

Point 1: Minimize Volatility & Incorporate New Investments

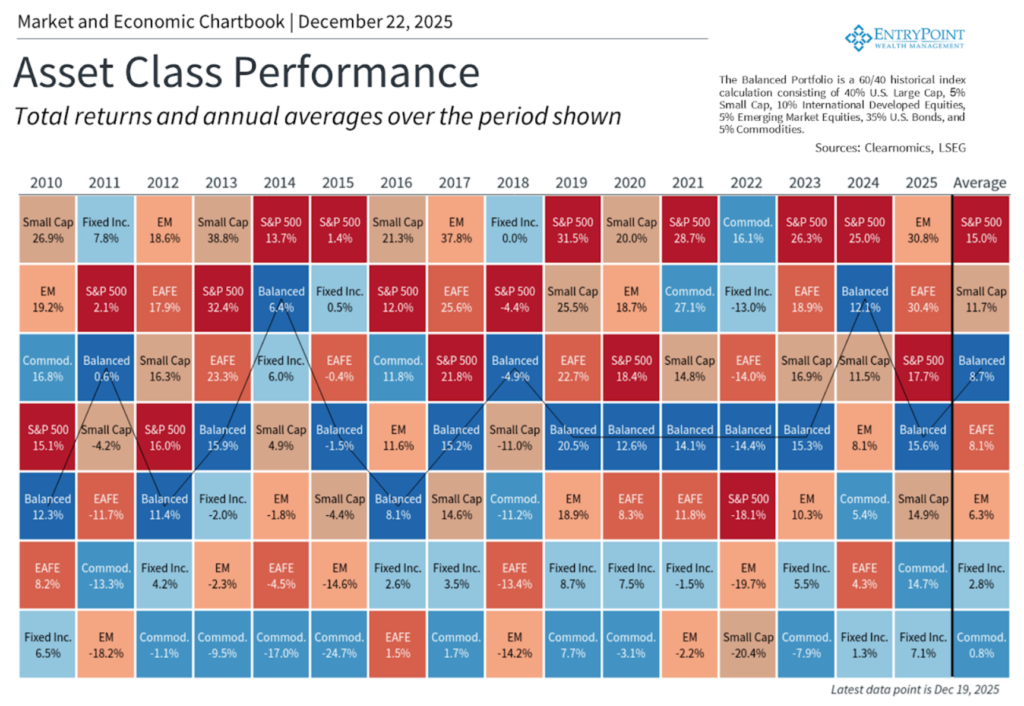

We maximized two major themes for our clients in 2023: we took steps to minimize the volatility within portfolios and incorporated new investments to increase cash returns.

The Federal Reserve pushed interest to 20-year highs, leading EntryPoint to invest in short-term CDs and other securities to maximize our conservative returns. In October, Interest rate long maturities pushed to 2023 highs as Government Bonds approached yields of almost 5% and Corporate Bonds achieved 5.6%. These higher rates are an opportunity for investors to earn a higher cash flow return and will increase portfolio income in the future.Point 2: The Magnificent 7 Continues to Dominate

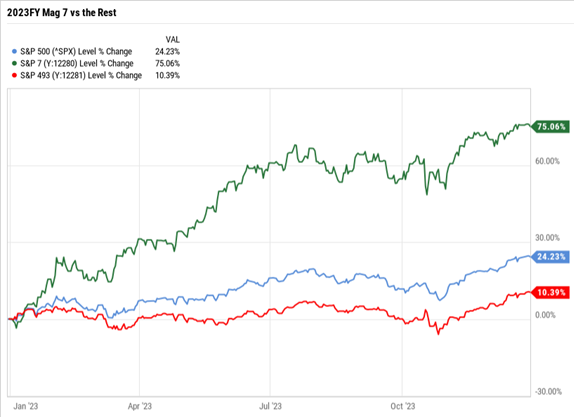

As an update to the Q3 Newsletter, the other central theme of 2023 was the concentration of equity returns in a small group of companies.

The “Magnificent 7” continued to dominate stock market returns, and EntryPoint maintained a tactical weight to these investments in the year’s second half. These seven technology stocks roared to a 75% total return, meaning an investment of $100 on January 1st would have grown to $175.06 at the end of the year. Driven by further technology adoption, significant demand despite inflation, and AI adoption themes, these stocks gained market share and increased earnings.

Point 3: Growth is Concentrated in Technology

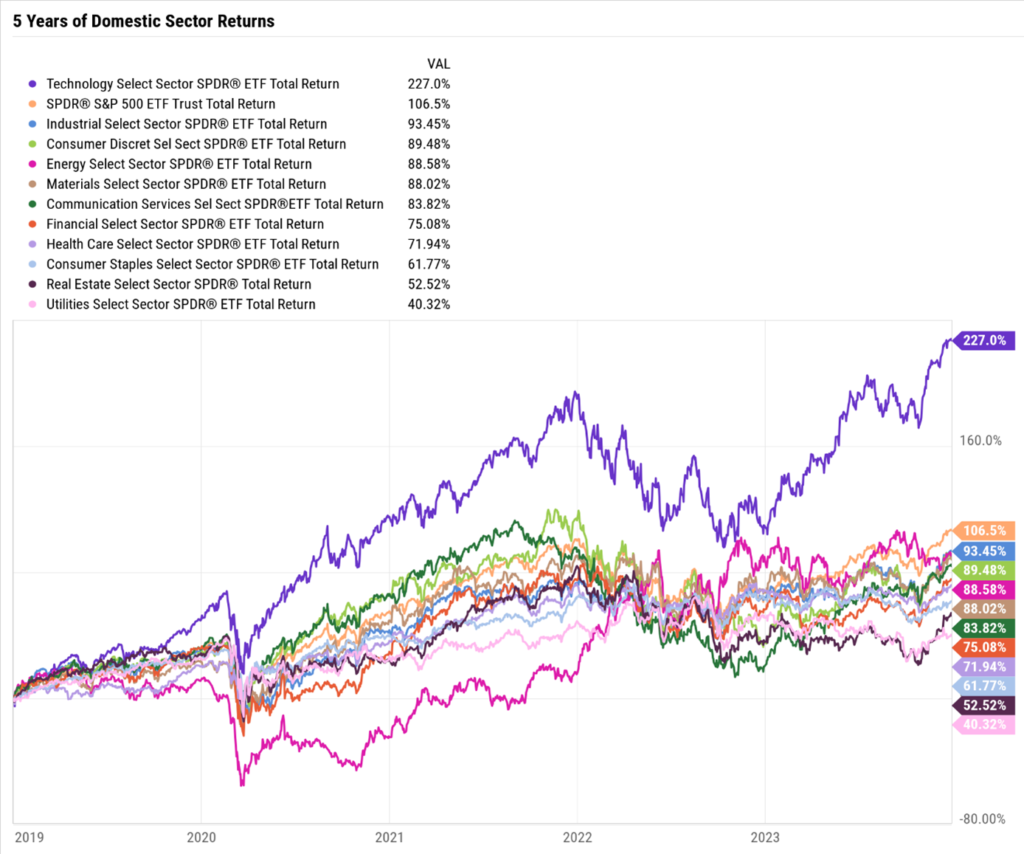

At the core of our investing philosophy at EntryPoint is that making tactical investing decisions can add value to investment returns over time. Tactical Investing is adjusting areas of your portfolio to be more concentrated in certain types of investments based on a particular economic environment. In 2022, we were overweight in Energy stocks; in 2023, we were overweight in Technology stocks. We believe that these investing themes are predictable and can benefit our clients as they work to build wealth.

It’s late January as I write this newsletter, and the financial headlines focus on the SP500 making new all-time highs. This is excellent news, as the value of the index has never been higher; the tricky part is that this growth is singularly concentrated in Technology companies. The chart below shows sector-based investing returns over the last five years, and you will notice that only one sector has outperformed the SP500. Most areas of our economy struggle to grow as our society deals with inflation, high-interest rates, and other economic issues. The growth in Tech Companies has been so dominant that it’s almost tripled the returns of every other sector.

Plan Your Next Step