Quarterly EntryPoints: Q3 2023

Point 1: The Magnificent 7

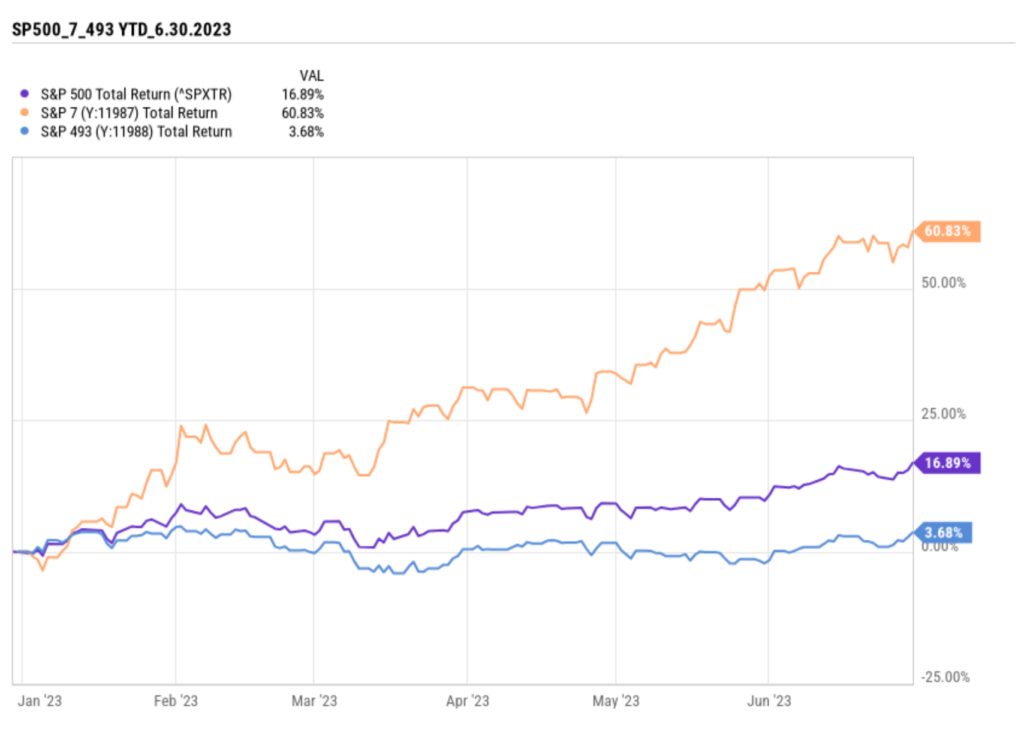

Markets got off to a hot start in 2023, boosted by strong economic metrics and the new technology theme, Artificial Intelligence. Through the first half of 2023, The SP500 returned an impressive 16.89%, primarily due to the returns from the Magnificent 7.

The following seven stocks returned over 60% in the first half of 2023: Microsoft, Amazon, Meta (Facebook), Apple, Alphabet (Google), Nvidia, and Tesla. The other 493 companies in the index provided a net return of only 3.7%.

I begs the question: Why be diversified?

Point 2: Interest Rate Adjustment

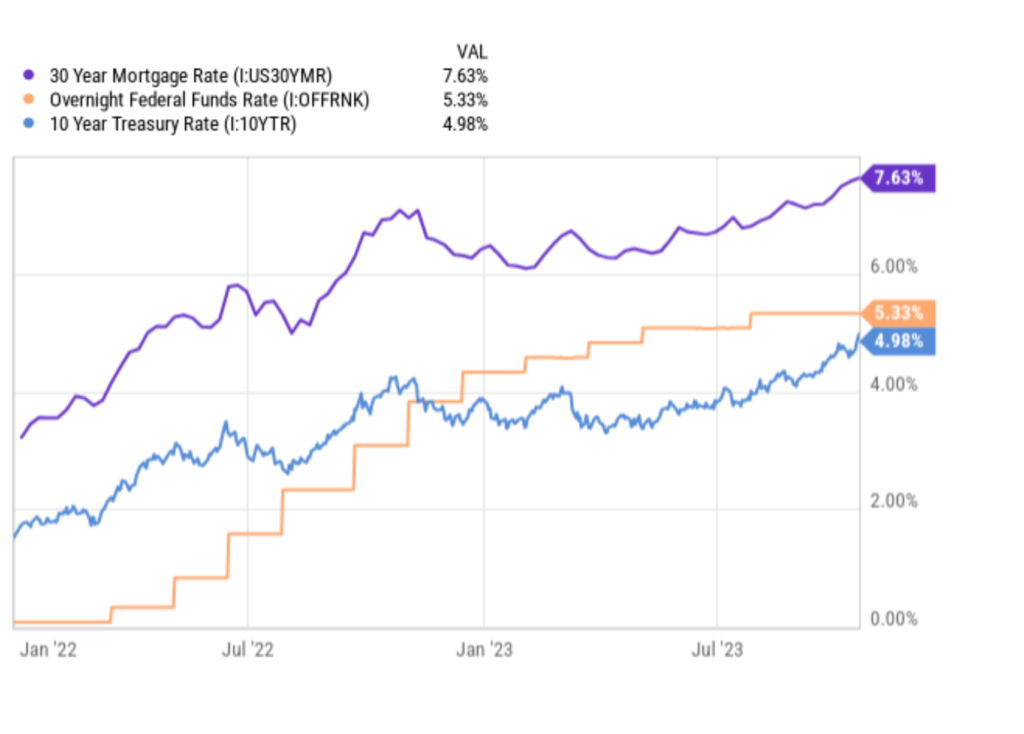

Markets finally started to assess the slowdown in Real Estate Transactions and the impact of rising costs on the American Consumer. Consumers are under pressure as wages are not increasing to keep up with rising prices due to inflation and the effect of rising interest rates. Home Ownership became a prominent topic in new headlines in Q3 as wesaw increasing home prices and rising interest rates on mortgage loans.

The Federal Reserve has brought inflation down dramatically by raising the FED Funds rate from Zero to 5.33% in the past 18 months. Consumers feel the effects of this rate-rising cycle seen through the 30-year Mortgage rate have moved from ~3% on January 1st, 2022, to almost 8% in October 2023.

Point 3: CHALLENGING INVESTMENT ENVIRONMENT

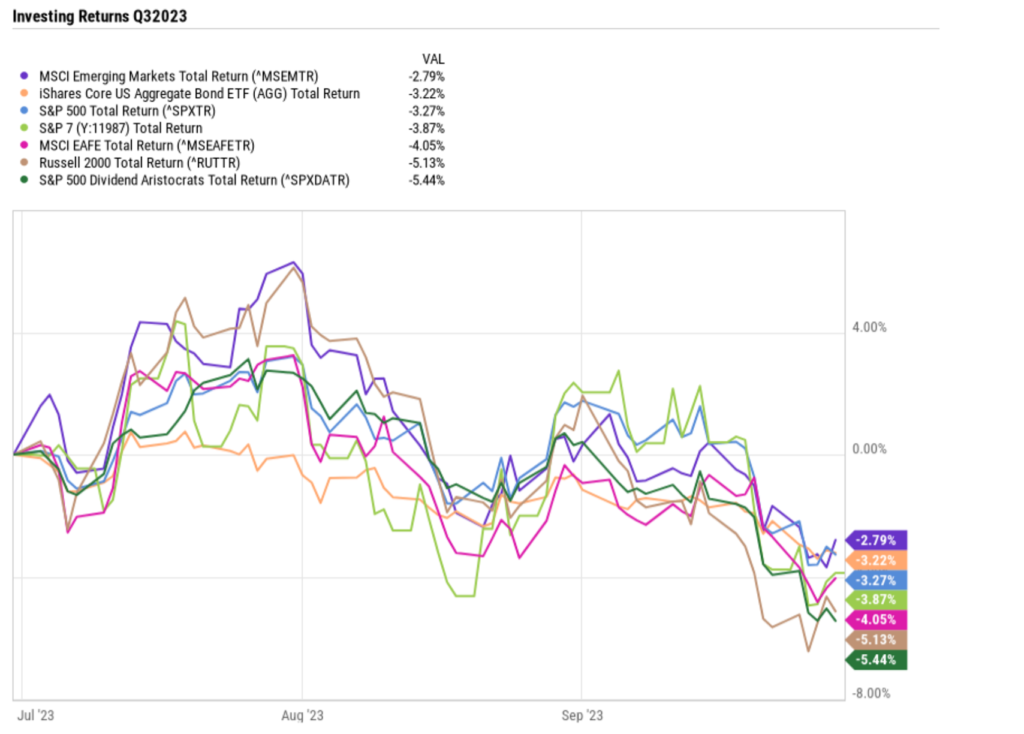

Our Final Chart focuses on the outcomes of investing in the third quarter of 2023. Major Market indexes were in the red as markets started to reprice the new interest rate environment. Given the strength of

our economy, a headline appeared – “Higher for Longer, meaning interest rates would be held higher than initially anticipated. Generally, high interest rates will slow economic activity, and most prognosticators expected interest rates to increase – and then come down rather quickly as the economy slowed. However, economic growth and labor markets have stayed elevated, leading to the realization that Interest rates will remain much higher than initially expected.

EntryPoint Wealth Management sold equity securities throughout the third quarter, leading to an elevated cash position. We aim to remove risk from client portfolios when necessary and avoid significant declines ni the market. As of September 30th, EPWMs’ Tactical Equity Strategy had a cash position of around 70%. Capital Markets made a high point in lateJuly, declining through late October.

Plan Your Next Step