RETIREMENT IN 2025: WHY INFLATION, LONGEVITY, AND FALLING RATES DEMAND A GROWTH-MINDED PORTFOLIO

If you’re retired or nearing that milestone, your top priority is ensuring your savings last as long as you do. Inflation has made this harder than ever, eroding the purchasing power of every dollar you’ve set aside. The essentials that dominate retiree budgets—healthcare, housing, and daily expenses—are rising faster than headline inflation numbers suggest.

While some prefer the perceived safety of cash, avoiding all risk can be the biggest risk of all. For long-term investors, the key is building a portfolio that preserves and grows your buying power. Here’s what today’s environment demands you understand.

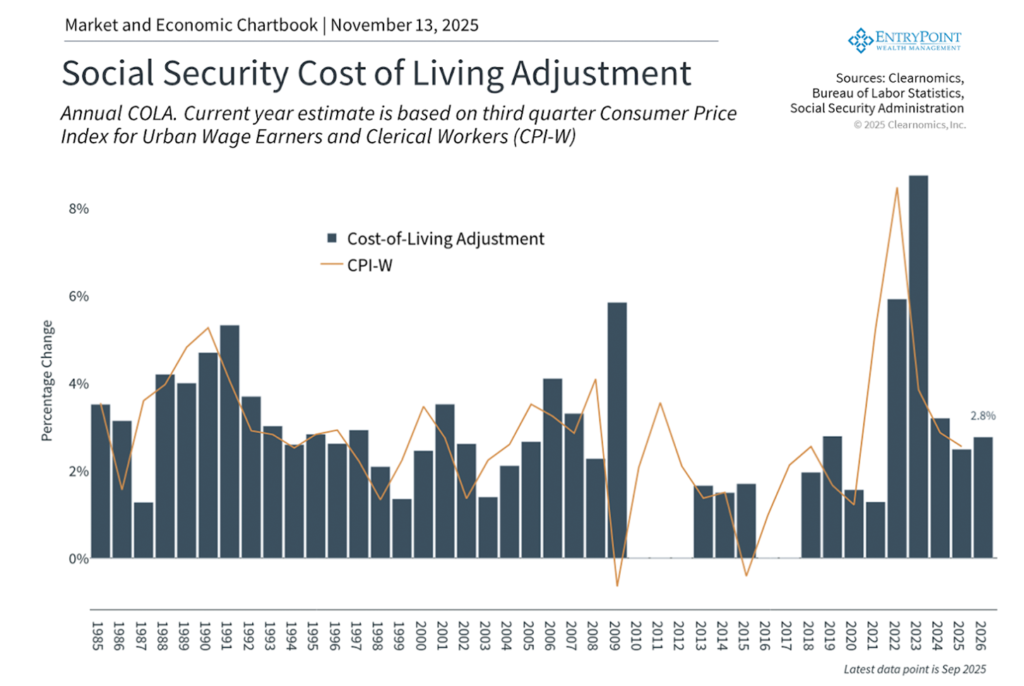

SOCIAL SECURITY COLAS WON'T FULLY PROTECT YOU

The 2026 Social Security COLA of 2.8% will boost the average monthly benefit by just $56, to $2,064. That’s a far cry from the 8.7% jump in 2023. Worse, the CPI-W index used to calculate COLAs tracks working-age households—not retirees.

Your reality:

- Medical care services: +3.9%

- Health insurance: +4.2%

- Homeowners insurance: +7.5%

- Meat, poultry, fish: +6.0%

- Dining out (full service): +4.2%

And Medicare Part B premiums are projected to rise $21.50/month in 2026—eating 38% of the average COLA before you see a dime. Once prices climb, they rarely retreat.

Social Security Cost of Living Adjustment

Annual COLA. Current year estimate is based on the third quarter Consumer Price index for Urban Wage Earners and Clerical Workers (CPI-W).

Annual COLA. Current year estimate is based on the third quarter Consumer Price index for Urban Wage Earners and Clerical Workers (CPI-W).

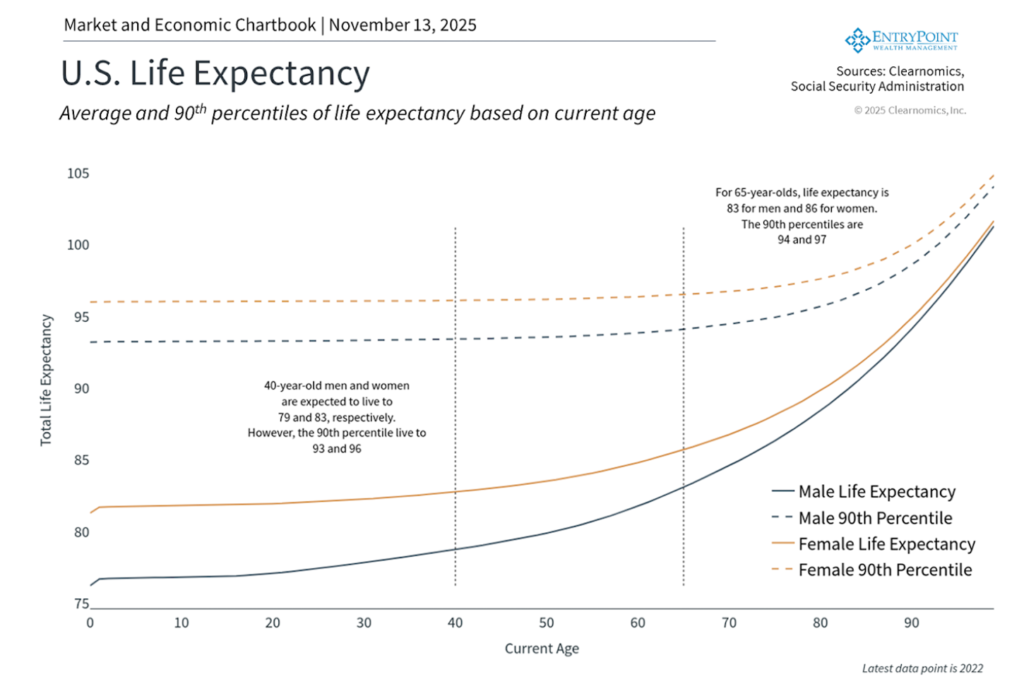

LONGEVITY RISK IS THE SILENT PORTFOLIO KILLER

We’re living longer—and that’s a gift with a price tag. A 65-year-old today has a 50/50 shot at reaching 83 (men) or 86 (women). The top 10%? 94 or 97.

A 30+ year retirement changes everything:

- Sequence-of-returns risk amplifies early drawdowns.

- Inflation compounds over decades, not years.

- Cash yields alone can’t outrun either.

This is why “income-only” portfolios fail. Growth assets like stocks aren’t optional—they’re survival tools. Historically, equities have outpaced inflation by 4–6% annually over long horizons.

Longevity Risk Is the Silent Portfolio Killer

Average and 90th percentiles of life expectancy based on current age.

Average and 90th percentiles of life expectancy based on current age.

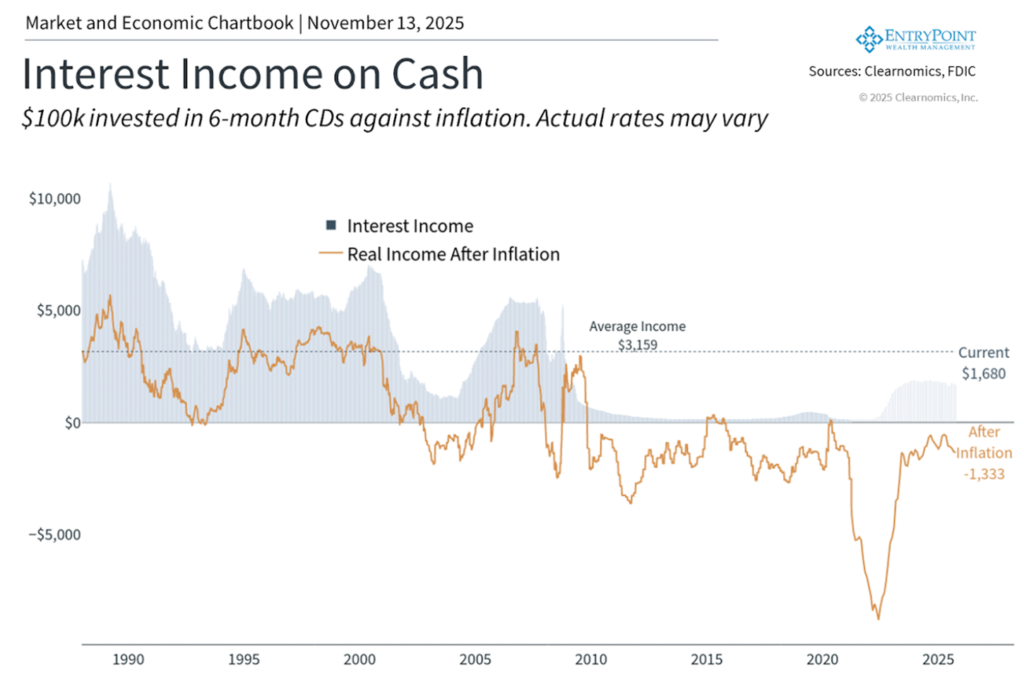

CASH IS QUIETLY LOSING THE BATTLE

With the Fed cutting rates, the era of 4–5% money-market yields is ending. Cash will soon earn less than inflation, guaranteeing a slow bleed in purchasing power.

Yes, keep 6–12 months of expenses liquid. But parking everything in cash? That’s a bet against your future self.

Cash Is Quietly Losing the Battle

$100 invested in 6-month CDs against inflation. Actual rates may vary.

$100 invested in 6-month CDs against inflation. Actual rates may vary.

THE SOLUTION: A BALANCED, GROWTH-ORIENTED PORTFOLIO

1. Stocks (40–60% for most retirees): Capture long-term inflation-beating returns.

2. Alternative Investments: Strategies engineered to deliver income and inflation protection with lower correlation to public markets.

3. Tactical cash: Cover near-term needs without over-allocating.

4. Dynamic withdrawals: Adjust spending based on market conditions and lifespan planning.

YOUR ACTION PLAN

- Stress-test your plan for a 30-year retirement at 3–4% inflation.

- Rebalance annually—don’t let emotions drive decisions.

- Work with a fiduciary advisor to model longevity, healthcare, tax scenarios, and alternative access.

Social Security helps, but it’s not enough. In an era of stubborn inflation, longer lives, and shrinking cash yields, growth isn’t greed—it’s prudence.

Let’s build a plan that doesn’t just preserve your wealth, but powers your retirement.

As a fee-only fiduciary, my priority is helping you retire with confidence and financial stability. If you want objective, personalized guidance on how to protect your purchasing power and sustain your income for decades, schedule a strategy session with me and let’s connect.

CHRIS WARD, CFP®

Chris has been helping clients as a Financial Advisor since 2007 and established EntryPoint Wealth Management as an opportunity to offer clients access to his best partnership for financial advice. He works as an integrated partner with you and your financial life, to help you better your financial situation and achieve your goals.

CONTACT CHRIS DIRECTLY: