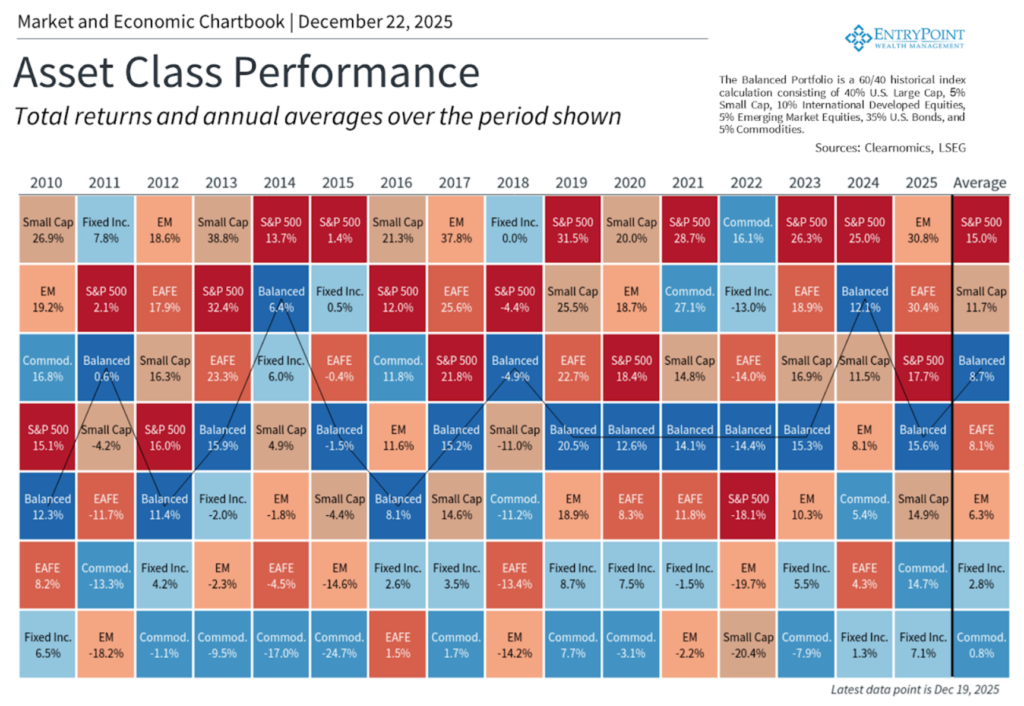

For six out of the last seven years, the stock market has delivered returns above 10%. This impressive run was only interrupted by the 2022 downturn caused by high inflation. As a result, many investors find themselves in a strong financial position.

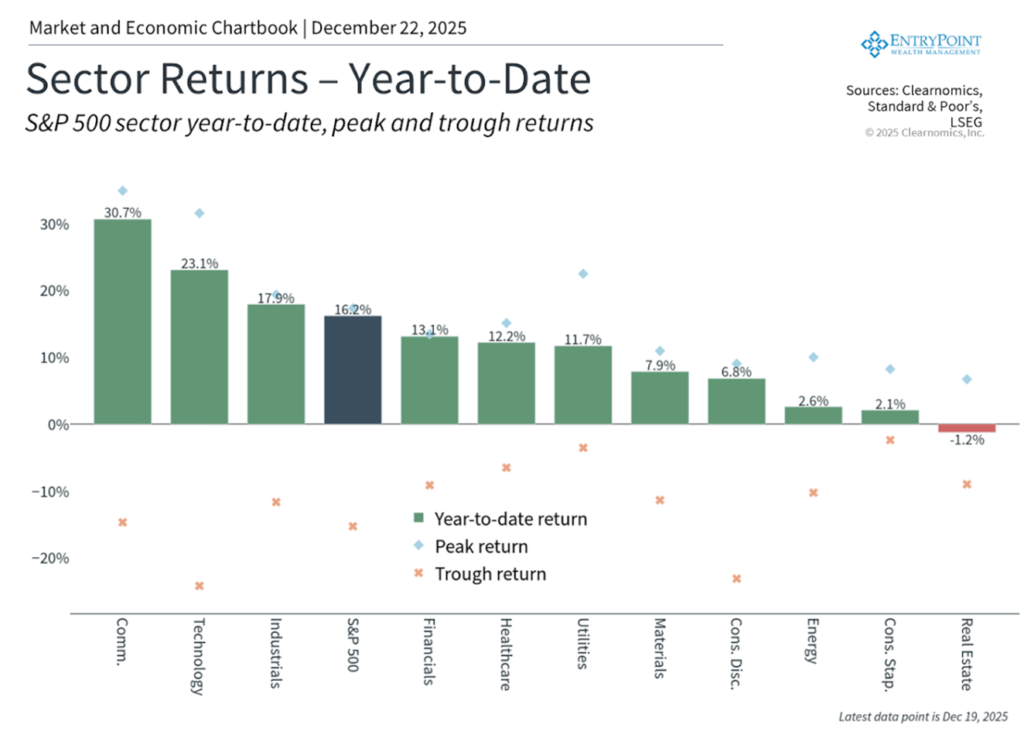

There’s a saying that looking forward to something can be more exciting than the actual event. On one side, investors always want strong returns like these, which are clearly good for their investment accounts and financial goals. This is especially true as the market has expanded beyond just artificial intelligence stocks, international markets have improved, and bonds have helped support portfolios. On the other side, once these gains happen, investors often become worried, particularly when major market indexes are near record highs and stock prices are approaching levels seen during the dot-com bubble.

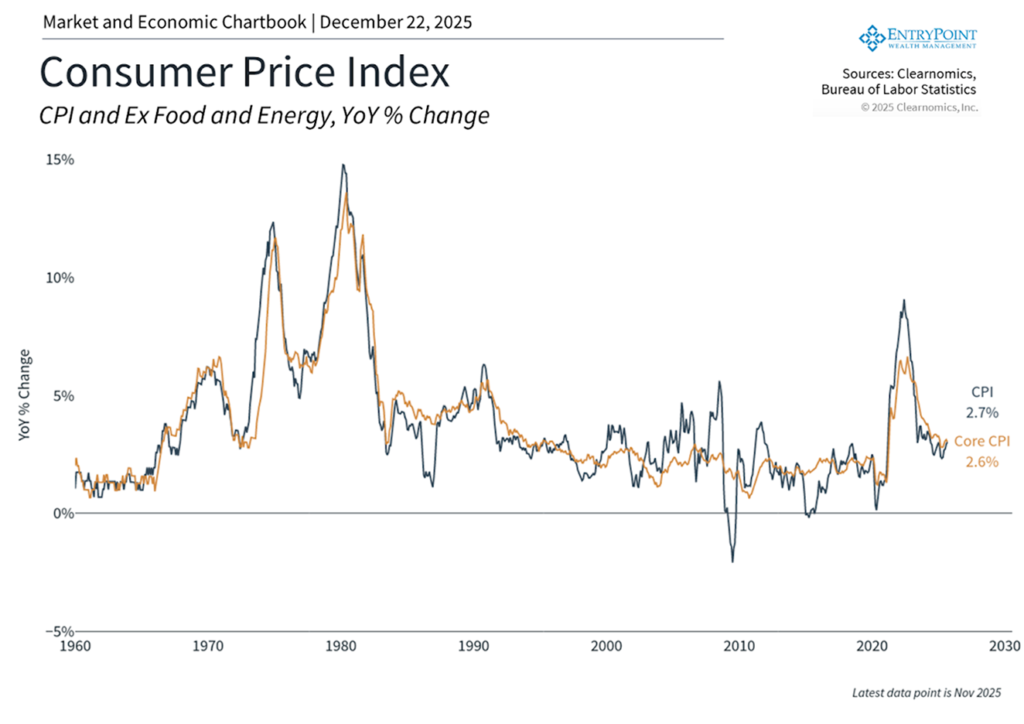

In 2025, we saw shifts in many of the challenges investors have dealt with recently. Inflation, which continues to affect household budgets, has leveled off around 3%. Tariffs (fees on imported goods), while higher than historical averages and a main cause of stock market swings in 2025, have not caused the economic problems many expected. The Federal Reserve (the U.S. central bank) has continued lowering interest rates, and the economy has grown at a steady pace.

Looking at the bigger picture, one of the most important lessons for the new year is that what investors worry about most often doesn’t happen. The recession many feared since 2022 never occurred. History shows that for every real market disruption, like the 2020 pandemic or 2008 financial crisis, there are many more feared events that never happen. The key for long-term investors isn’t trying to predict which events will matter, but staying calm and disciplined in all market conditions.

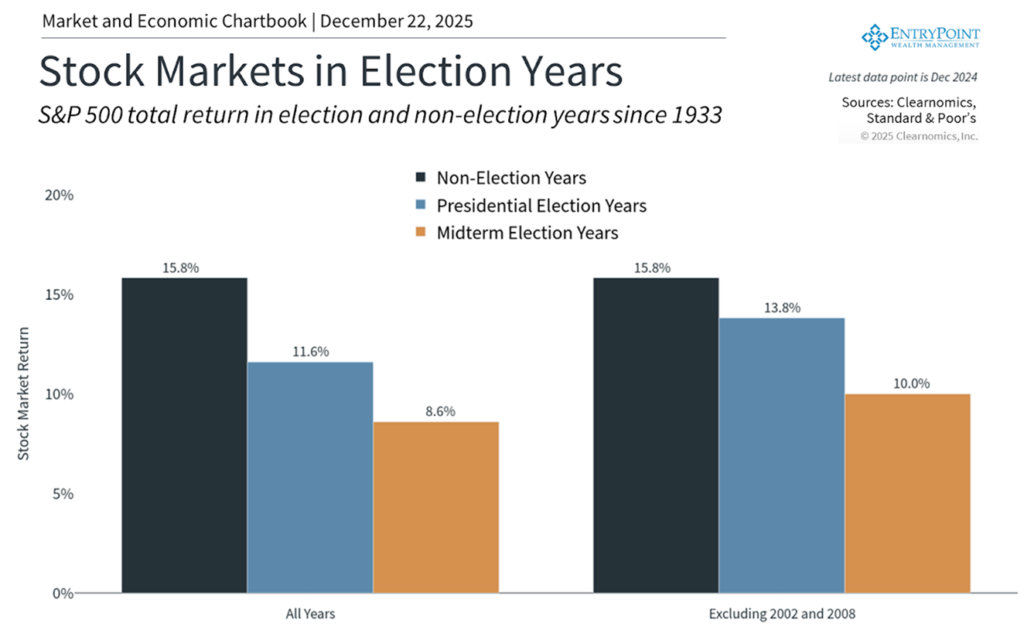

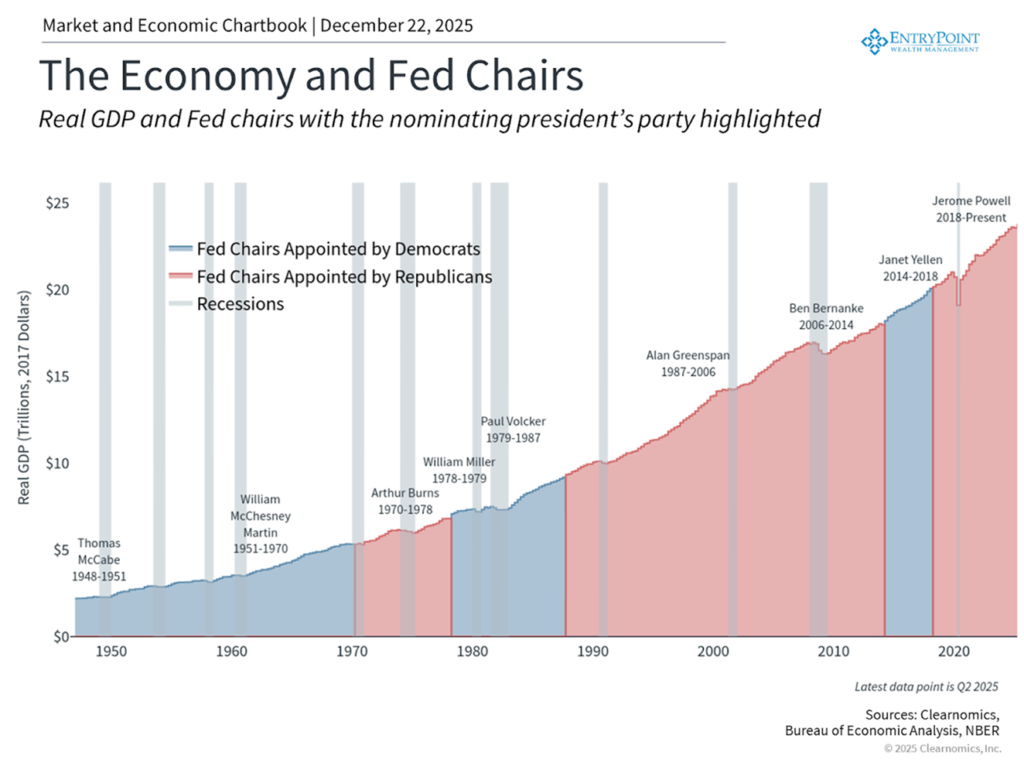

As we look toward 2026, the investment world presents both possibilities and challenges. Topics likely to make headlines include the upcoming midterm election, new leadership at the Federal Reserve, the future of AI, growing worries about loans, changes in the U.S. dollar’s value, and more. What matters most isn’t whether investors can predict every change, but whether their portfolio is set up to handle uncertainty while capturing long-term growth. Here are seven important themes to help guide your thinking about the year ahead.

In the coming year, this highlights the importance of balance and spreading your investments across different types. While it may be tempting to make sudden portfolio changes based on news headlines, investors who stick with their financial plans are likely to be rewarded.

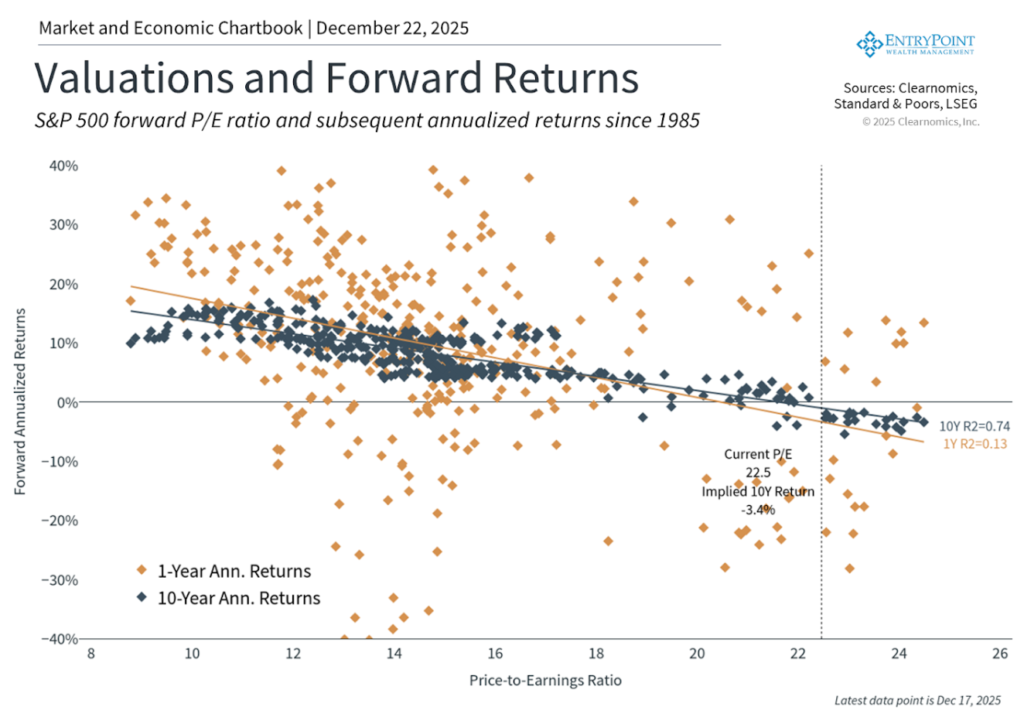

So, it’s important to understand what high stock prices do and do not tell us. High prices don’t necessarily predict immediate market declines since markets can remain expensive for long periods. While some investors worry about an “AI bubble,” the reality is that not all bubbles burst dramatically. Instead, some deflate slowly as company performance catches up. This is one difference between the dot-com crash of the late 1990s and early 2000s and the growth of cloud computing over the past decade.

However, high prices do suggest that returns could be more modest going forward, since markets are already accounting for future growth. This can also make the market more sensitive to disappointments. Investors often say that markets like these are “priced for perfection,” so even minor misses on earnings or economic data can cause volatility (significant price swings). This means that being selective and maintaining balance across different parts of the market – including different types of investments, industries, company sizes, investment styles, and more – will only grow in importance.

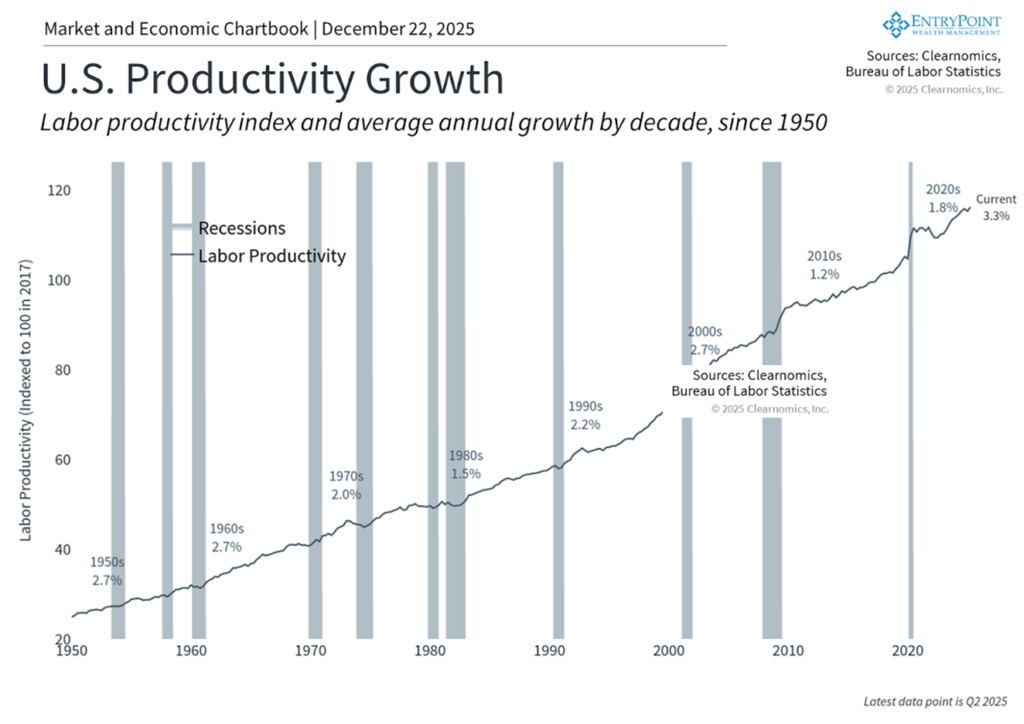

When it comes to long-term economic growth, perhaps the most important question is whether productivity will rise due to recent technological advances. Productivity measures how much, either in terms of quality or quantity, a worker can produce in a given amount of time. Historically, better equipment, training, and education have driven greater productivity, which is what drives real economic growth.

As the chart above shows, productivity growth averaged only 1.2% per year during the 2010s. The hope of AI and new technologies is a boost to worker output. However, this often takes longer than expected, and won’t necessarily benefit everyone equally. For investors, the promise of greater productivity is that profit margins can improve, supporting the broader economy and investor portfolios.

For long-term investors, it’s important to recognize what we can and cannot control. For example, the national debt has been a challenge for decades, yet making investment decisions based on these concerns would have resulted in the wrong portfolio positioning. While the sustainability of the U.S. federal debt may have implications for economic growth and interest rates, history shows that this should not be the primary driver of portfolios.

Instead, what investors can control in the short run is understanding the key changes to tax legislation and how it impacts long-term planning. These include the fact that lower tax rates from the Tax Cuts and Jobs Act are now permanent, estate tax exemption levels (the amount you can pass on without taxes) will remain higher, SALT deduction caps (limits on state and local tax deductions) have risen, and many other provisions. It’s the perfect time to review your tax strategies to ensure you take full advantage of these new rules.

As we enter 2026, investors face a familiar challenge: balancing concerns with the reality that markets have consistently rewarded patient, disciplined investors over time. The list of worries is ever-present, yet history suggests that for every crisis that disrupts markets, many more feared events have failed to happen. What separates successful long-term investors isn’t the ability to predict which concerns matter most, but the ability to stay balanced throughout all phases of the market cycle.

The bottom line? Markets have delivered strong returns, but high stock prices and slower global growth suggest more modest expectations for 2026. Rather than attempting to time the market based on any single concern, investors should focus on maintaining balanced portfolios positioned for various outcomes.