WHAT GOVENRMENT SHUTDOWNS MEAN FOR YOUR INVESTMENTS

Washington is once again dealing with a government shutdown. This happens when politicians can’t agree on a new budget to keep the government running. This year has already seen a lot of policy changes around trade, taxes, and immigration that have created uncertainty.

If you’re an investor, you might be worried about how these political issues could affect your money. The good news is that history shows government shutdowns usually don’t have much impact on the stock market or economy. Understanding this can help you stay calm during political disagreements in Washington.

SHUTDOWNS USUALLY DON'T AFFECT MARKETS MUCH

Every year, the government needs to pass a budget by October 1st to fund its operations. When politicians can’t agree on a budget by the deadline, the government shuts down. This means some government services stop and workers are sent home without pay temporarily.

Congress rarely passes budgets on time. In fact, over the past fifty years, they’ve only met the deadline a few times. Usually, they pass a temporary funding measure called a “continuing resolution” to keep things running while they negotiate. Republicans are currently proposing a seven-week temporary bill.

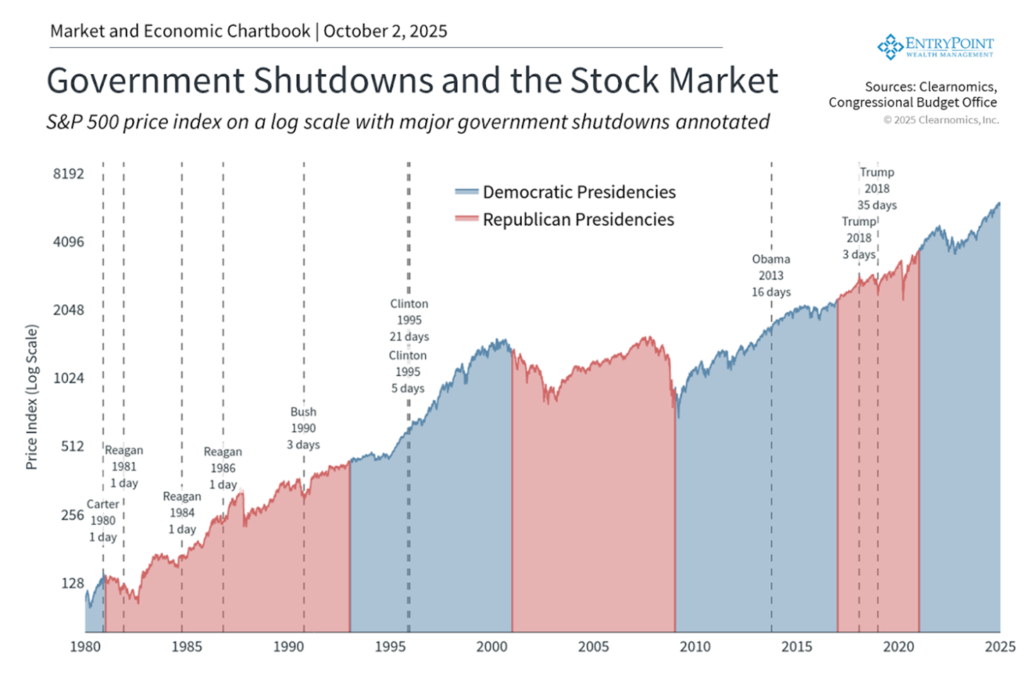

The chart shows that shutdowns have happened regularly since 1980 under both Democratic and Republican presidents. Even the longest shutdown ever – 35 days from late 2018 to early 2019 – didn’t cause lasting problems for financial markets.

Government Shutdowns and the Stock Market

S&P 500 price index on a log scale with major governments shutdowns annotated.

S&P 500 price index on a log scale with major governments shutdowns annotated.

WHY SHUTDOWNS HAPPEN

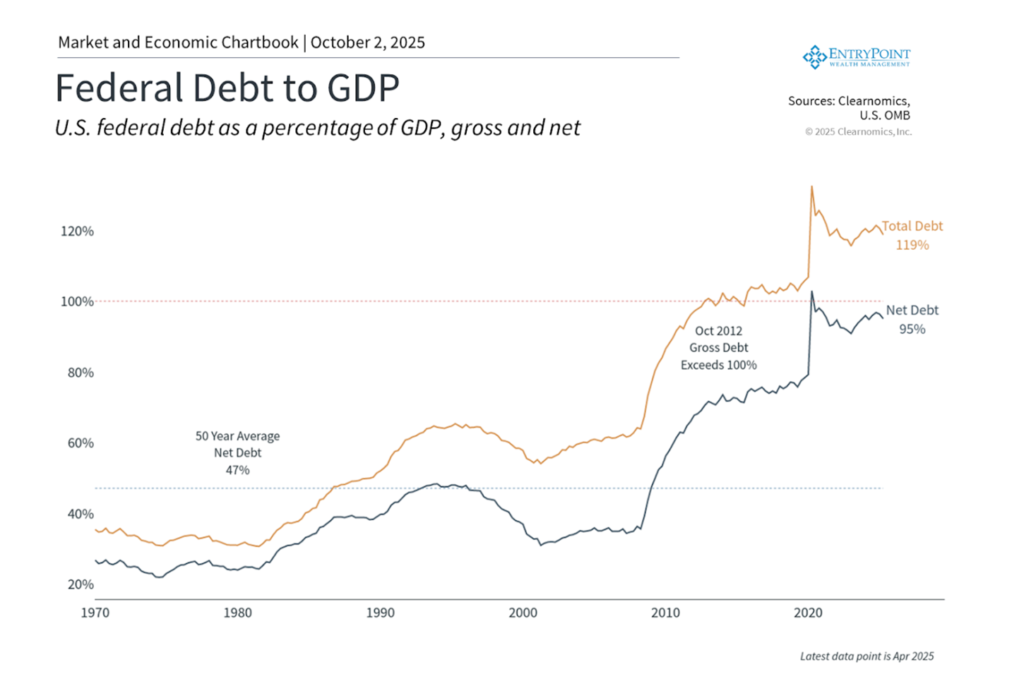

Right now, politicians disagree mainly about healthcare spending. These budget fights reflect bigger disagreements about the role of government. With federal debt now around 120% of GDP (a measure of the economy’s size), many agree the government needs to spend less, but they disagree on how to do it.

While shutdowns are temporary, they can delay important economic reports like jobs numbers and inflation data. They can also slow economic growth slightly if they last long enough, as federal workers delay spending.

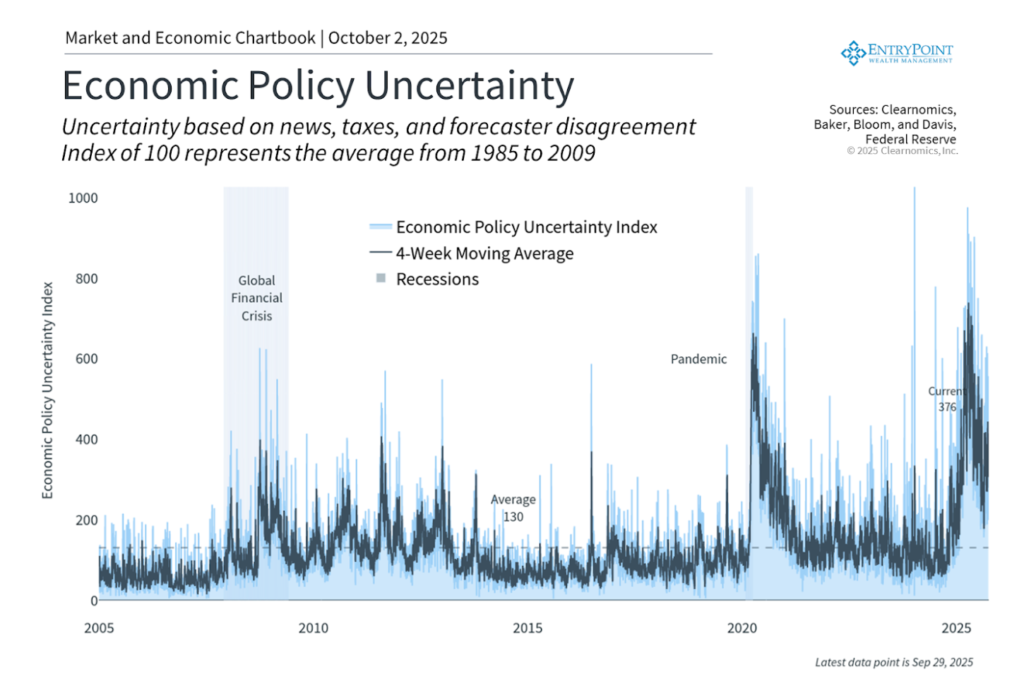

Economic Policy Uncertainty

Uncertainty based on news, taxes, and forecaster disagreement. Index of 100 represents the average from 1985 to 2009.

Uncertainty based on news, taxes, and forecaster disagreement. Index of 100 represents the average from 1985 to 2009.

MARKETS CARE MORE ABOUT THE BIG PICTURE

The final chart shows that tariffs and taxes earlier this year created more uncertainty than usual. However, now that those issues have been resolved, uncertainty has fallen back to normal levels. Even when shutdowns do happen, they typically don’t last long enough to change the fundamentals of the economy.

The bottom line? Government shutdowns make headlines and create real problems for government workers, but they historically haven’t had much impact on financial markets. As an investor, it’s best to stick with your long-term financial plan rather than worrying about day-to-day political news.

Economic Policy Uncertainty

Uncertainty based on news, taxes, and forecaster disagreement. Index of 100 represents the average from 1985 to 2009.

Uncertainty based on news, taxes, and forecaster disagreement. Index of 100 represents the average from 1985 to 2009.

If the headlines have you second-guessing your investment strategy, let’s talk. I help investors cut through the noise, focus on what really drives markets, and stay invested with confidence — no matter what’s happening in the news. Schedule a strategy session with me and stay on course toward your retirement goals.

CHRIS WARD, CFP®

Chris has been helping clients as a Financial Advisor since 2007 and established EntryPoint Wealth Management as an opportunity to offer clients access to his best partnership for financial advice. He works as an integrated partner with you and your financial life, to help you better your financial situation and achieve your goals.

CONTACT CHRIS DIRECTLY: